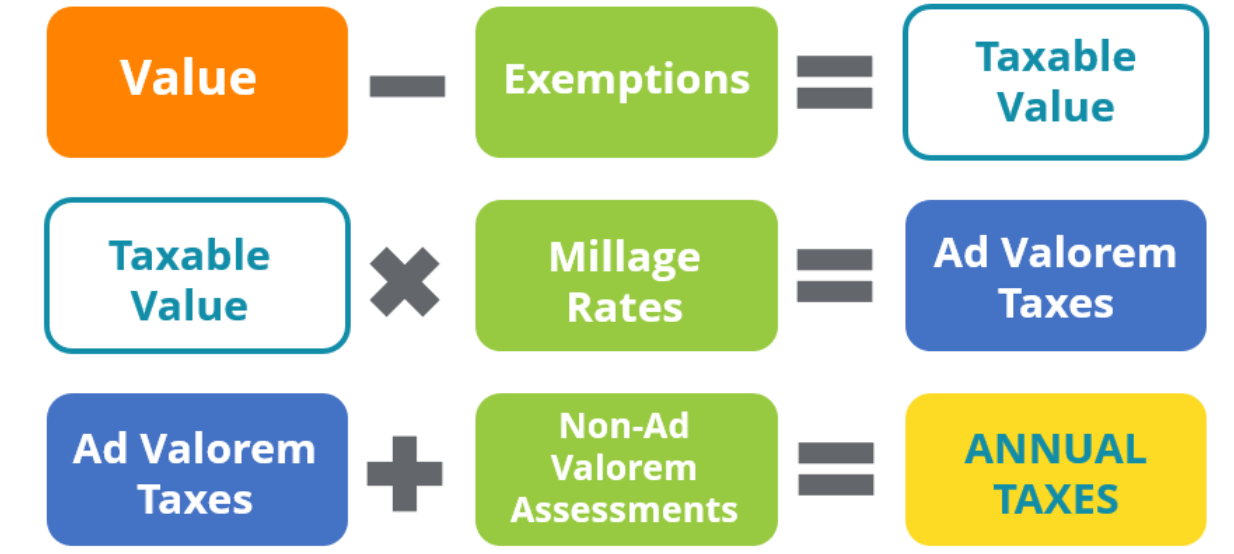

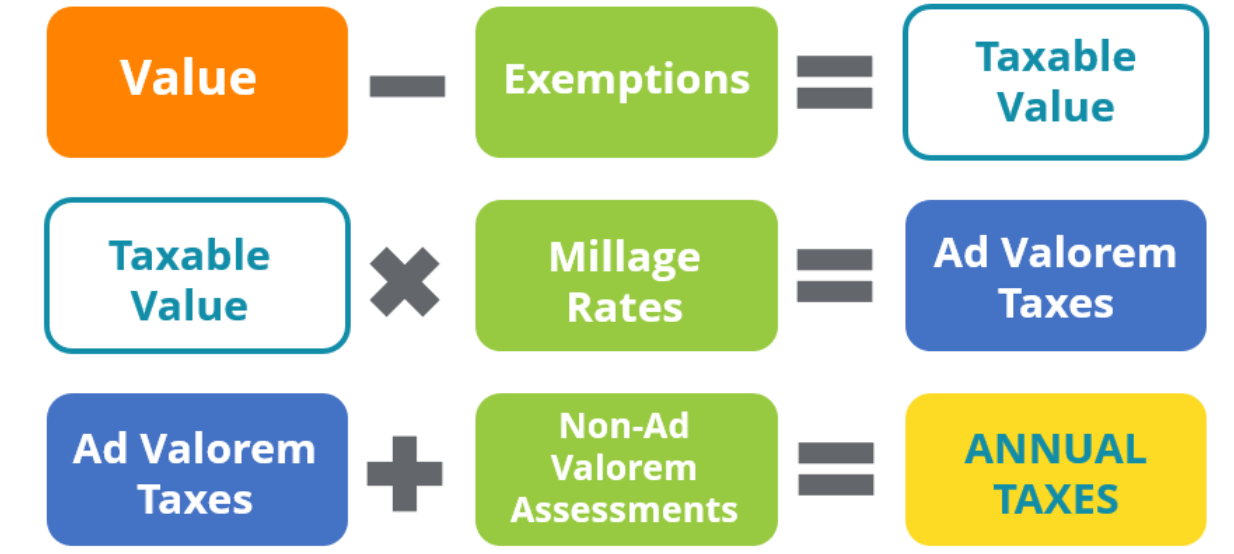

Real estate property taxes, also referred to as real property taxes, are a combination of ad valorem taxes (assessed value of your real estate) and non-ad valorem taxes (services or infrastructure that affect your property.)

The Property Appraiser is responsible for determining the value of all property within the county. Exemptions are subtracted from the value to calculate taxable value. The taxable value is then multiplied by the millage rate, set by individual taxing authorities like the Board of County Commissioners, School District and Water Management Districts. That determines your Ad Valorem Tax.

The ad valorem total is then added to the non-ad valorem assessments which are also set by the Taxing Authorities for things like fire services and solid waste services. The combined total determines your annual taxes.

The Tax Collector is responsible for printing, mailing, and collecting tax payments once the Property Appraiser and other local taxing authorities certify the tax roll.

If you have questions on your value or exemptions, you can visit the Property Appraiser’s website or call 239.533.6100.

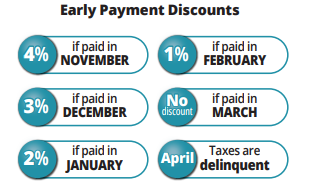

Current year taxes are billed in November, with payment due by March 31st of the following year. Discounts are given for early payment November through February. You can check the status of your property tax account online.

Taxes paid in November receive a 4% discount, December is a 3% discount, January is 2% and February is 1%. Taxes are due on March 31.

When the discount period on current taxes ends on a weekend or holiday , the discount is extended to the next business day .

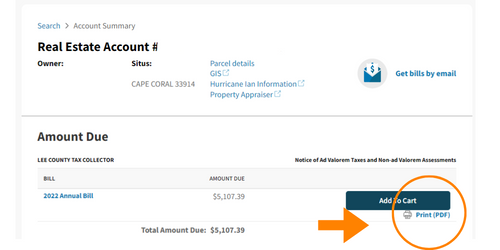

If you have not received your tax bill by postal mail, you can view, pay, or print your bill online.

If you have an escrow account with your mortgage provider, you can confirm payment has been made by viewing your account online .